Get Started with Mintlink Today!

Automate your “link please” comments and start earning today. Download the free Mintlink app!

Table of Contents

Influencer marketing in India isn’t just an add-on to the media plan for 2025. It has become a strategic lever that shifts how brands build trust, relevance, and growth. If your brand still treats creators as “nice to have”, you’re already a step behind the ones who use them as growth engines.

The Problem – Why Traditional Brand Strategies Are Under Pressure

Brands in India face multiple challenges:

- Fragmented attention: With mobile usage exploding and social platforms dominating time spent, legacy ad formats are losing impact.

- Trust deficit: Consumers increasingly skip brand-messages and gravitate toward peer-like signals.

- Scale & relevance trade-off: Brands want loyalty and authenticity, but also the scale of reach—and the two often conflict.

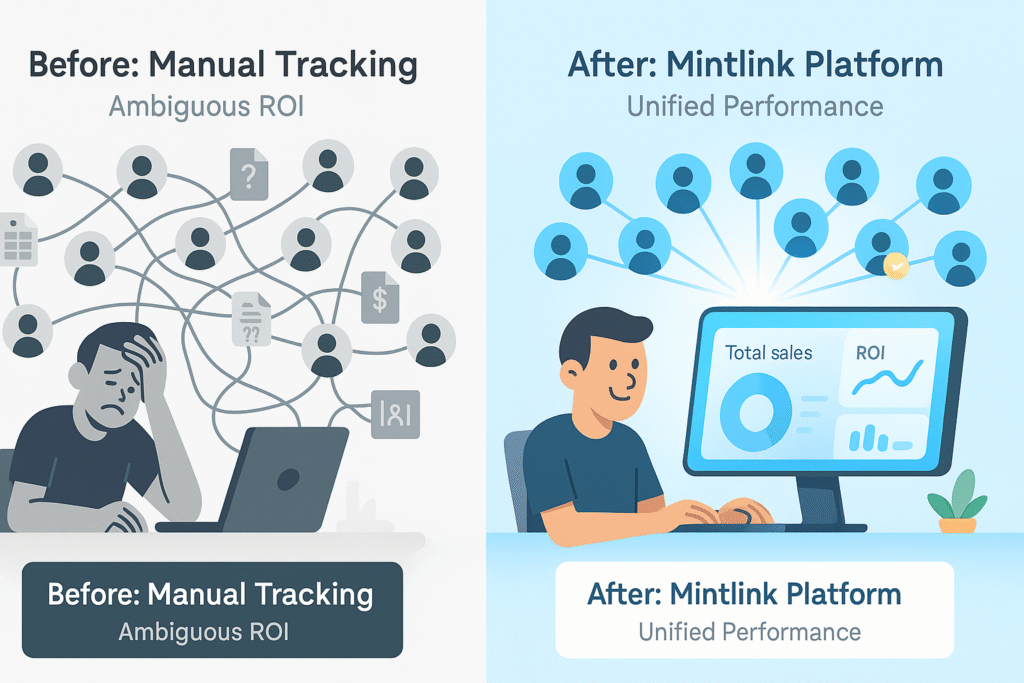

- Measurement ambiguity: Many influencer engagements are still treated as awareness plays—not tightly integrated into business metrics. According to EY (EY Japan), determining ROI remains a top challenge.

In this context, influencer marketing is moving from campaign level to business level—for brands attentive enough to connect it to their core strategy.

Major Impacts on Indian Brands – What’s Shifting

1. Shift in Budget & Strategic Weight

The influencer marketing sector in India is projected to hit ₹3,375 crore by 2026 with about 18% CAGR, per EY. (EY Japan)

- 56% of brands have already invested more than 2% of their marketing budget in influencer marketing. (EY Japan)

- Around 75% of brands view influencer marketing as part of their overall brand strategy. (Financial Express)

POV: This means influencer marketing is no longer experimental or peripheral — it’s institutional. If your brand doesn’t plan for it, you’re missing a fundamental media channel.

2. Influence on Purchase & Consumer Behaviour

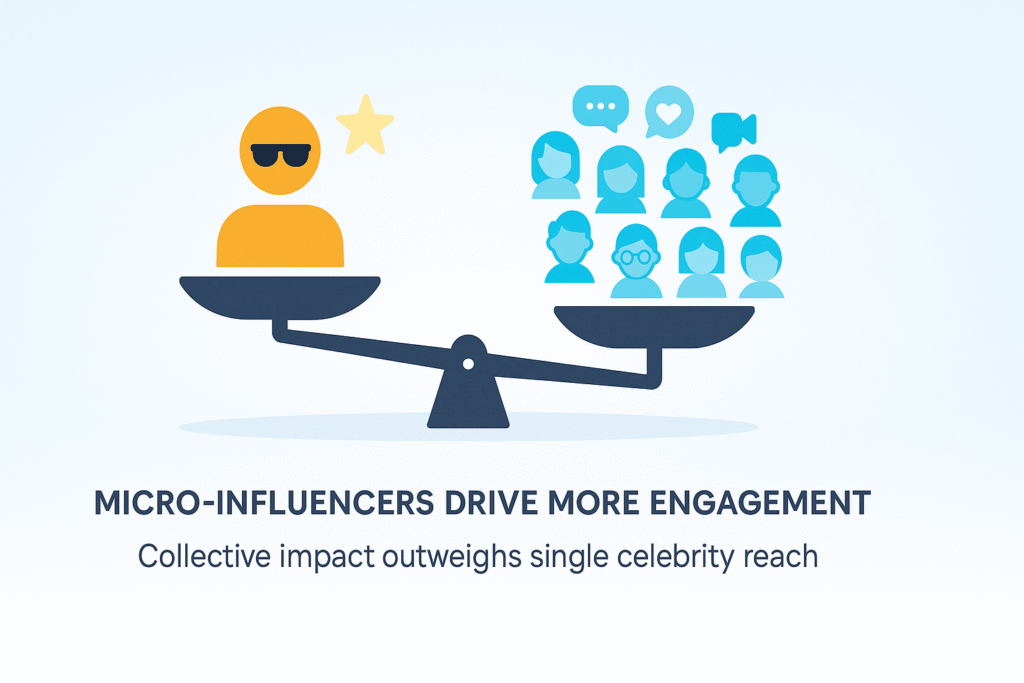

Brands increasingly recognise that influencers (especially micro/nano) are trusted voices in India. Per EY, engagement rate and quality of target audience are key criteria when selecting influencers. (EY Japan)

For certain categories like beauty, fashion, and men’s grooming, the access point is shifting: consumers see creators first → brand second.

POV: Brands need to stop treating influencers as “amplifiers” of brand content, and start treating them as entry points to consumer communities.

3. Channel & Format Changes

50% of time spent on mobile phones in India is dedicated to social media platforms — making the creator channel essential. (EY Japan)

The rise of short-video, regional-language creators, and non-metro creator audiences are changing the mix of how and where brands show up. (Campaign India)

POV: For brands, this means localisation and platform-specific strategy are not optional. The influencer ecosystem brings regional reach, vernacular authenticity—and brand strategies must shift accordingly.

4. Re-defining Metrics & Long-Term Relationships

While awareness & engagement were earlier primary metrics, more brands now are exploring performance-linked models (though still a minority). (The Economic Times)

Brands are increasingly treating influencers as partners, not transactional assets. Long-term collaborations are gaining ground.

POV: Brands who treat influencers as one-off campaigns will lag. The ecosystem rewards consistency, repeated exposure, and integrated partnerships.

5. Category & Brand Implications

Categories with strong personal connection (lifestyle, fashion, beauty) are leading. (EY Japan)

But even categories previously considered “low fit” for influencer marketing in India (e.g., automobiles, consumer durables, FMCG) are increasing their spend. (Campaign Asia)

POV: Whether you’re a D2C brand or a large legacy brand, the principle holds—creator-led storytelling is becoming a required part of brand building and not just performance marketing.

Real Examples & Strategic Implications

- A large Indian brand in the FMCG space might previously have focused on TV + print. Now they are allocating a portion of budget to 10-15 micro-influencers who generate content in regional languages, driving engagement in Tier 2-3 markets.

- Brands that keep re-using the same creator faces, rather than a steady stream of one-offs, are seeing stronger trust signals (according to anecdotal industry feedback aligned with EY insights).

- Brands are shifting selection criteria: rather than “follower count” they ask “What is the creator’s engagement rate? What audience do they reach? Is it my target?” – this shift is flagged in the EY report. (The Economic Times)

POV: The brands that integrate influencers into their story and distribution fly ahead of those who treat them as simple media placements.

Actionable Take-aways for Brands in India

Strategic Planning

- Include influencer marketing in India from the start in your communication strategy—not as an add-on.

- Allocate minimum 2-3% of marketing budget (as per market benchmark) to influencers if you’re serious.

- Segment your creator strategy: micro/nano for engagement + regional reach, macro/mega for awareness and scaling.

Creator Selection & Activation

- Focus on engagement rate + audience quality over follower count.

- Build longer-term relationships with creators — repeated collaborations yield higher trust.

- Prioritise regional language creators and Tier 2-3 market creators if your business is national or growing outside metros.

Measurement & KPI Setup

- Define clear objectives for influencer campaigns: awareness, consideration, purchase, retention.

- Move beyond “likes and reach” – align with business metrics (website traffic, conversions, brand metrics).

- Consider testing performance-linked models or hybrid compensation (fixed + performance) to drive accountability.

Content & Channel Strategy

- Leverage mobile + social culture: short-form videos, live commerce, vernacular content.

- Cross-platform interplay matters: e.g., YouTube + Instagram, regional apps, vernacular short-video platforms.

- Enable creators to tell brand stories in their voice — authenticity cannot be compromised.

Scale & Sustainability

- Treat influencer marketing as a machine not as one-off campaigns.

- Build internal or agency workflow: creator discovery, KPI dashboards, campaign review loops.

- Establish brand safety, creator authenticity norms, and regular audits (fake followers, engagement pods).

- Monitor evolving platform algorithms, formats and regional penetration trends.

The Technology Layer (The ‘How’): Mintlink

All this strategy (measurement, performance-linked models, scaling micro-influencers) is impossible to manage on a spreadsheet. This programmatic approach requires a technology partner.

This is where Mintlink comes in.

Mintlink is the engine built for this new era of performance-based creator marketing. While you focus on strategy, Mintlink provides the “Measurement & KPI Setup” and “Operational Layer” you need to scale:

- Unified Measurement: It’s a single dashboard to track every click, conversion, and commission from all your creators, from micros to macros. This solves the #1 challenge of ROI ambiguity.

- Performance-Based Payouts: It’s built for the affiliate model. You can stop “paying for posts” and start paying for performance, which is exactly what the market is shifting towards.

- Creator-Side Automation: Mintlink is also a creator tool. It empowers your influencers with Instagram Comment Automation, turning their “link please” comments into sales and giving you clean, real-time attribution data.

You can’t build a “predictable compounding” engine without the right technology. Mintlink is that engine.

Conclusion – Strong Closing POV

In India’s dynamic marketing environment, influencer marketing in India is no longer a “nice-to-have”; it is foundational. The brands that will lead in the next 3-5 years won’t be the ones that simply spend more—they will be the ones that integrate creators deeply, treat them as strategic partners, align influence to business metrics and execute with consistency.

If your brand still sees influencers as just another channel, you’re missing out. Because in India today, creators are the distribution, the trust amplifier and the culture connector for your brand. Treat them as such, and you’ll turn your influencer spends into actual business growth.

Time to shift mindset. Influence isn’t just exposure—it’s conversion, connection and culture.

Frequently Asked Questions (FAQs)

Q1: What is the main trend in influencer marketing in India for 2025? A: The main trend is the shift from paying for “reach” (follower count) to paying for “performance” (measurable results like sales and conversions). Brands are building long-term partnerships with trusted micro-influencers instead of one-off celebrity posts.

Q2: Why are brands in India using micro-influencers more? A: Because trust and engagement are the new key metrics. Micro-influencers in Tier 2 and Tier 3 cities often have a 3X higher comment rate and a more authentic, accessible connection with their audience, which leads to more trust and higher conversions.

Q3: How do brands measure the ROI of influencer marketing? A: The best brands are moving beyond “likes and reach.” They use performance-linked models, like affiliate marketing, to track every click, coupon code, and sale. Platforms like Mintlink provide a single dashboard to measure this ROI in real-time.